In this blog I’m going to look at what has led to cost management becoming such a huge challenge for the industry: what has caused it and how game studios can adjust their approach to gaming infrastructure to reduce the pressure it’s putting on already stretched budgets.

There are two main drivers – the money that it takes to make, deliver and run a successful game today, alongside the difficulty of accessing that money through investment.

On the surface, the nearly $300 billion estimation of the gaming industry is promising. With three billion active players, it is worth almost double the film and music industry combined. Take Rockstar’s forthcoming release of Grand Theft Auto VI. It’s projected to clear $1 billion in sales in the first week. Some experts think it will go over and beyond that in the first 24 hours.

But dig a little deeper, and you’ll find that the industry has been facing a hard time. “It is no understatement to say 2023 was probably the toughest year for indie and AAA publishers in a very long time” explains video gaming analyst Patrick O’Donnell.

Unmet financial targets post pandemic and higher interest rates mean investors are reluctant to put their money into the gaming industry. Combined with the rising overheads of creating a video game and ever-growing player expectations, game studios worldwide are feeling the pressure of managing costs.

“Money became more expensive this last year” says Raphael Stange, CEO of Nitrado. “It’s not as easy to get investments and the pressure of cost management is higher. The conversation this year as I perceive it is about cost, in comparison to what it was before, which was rather about growth.”

Raphael Stange, CEO of Nitrado, shares his take on the hot topic of 2024 in the gaming industry.

Back in 2021, former Sony Interactive Entertainment America CEO Shawn Layden pointed out that game development costs seem to double with each generation, and predicted that the $100 million budget needed for PS4 games will turn into $200 million needed for PS5 games. Layden wasn’t wrong; Call of Duty Modern Warfare 2, which launched in 2022, had a staggering budget of $250 million.

There are two main reasons for this huge rise in budgets: player expectation, and technological advancement.

Gone are the days of Pong where hours of entertainment would be derived from two colours and only a handful of pixels (unless you’re playing Banana, which at the time of writing this has 350,000 concurrent users on Steam, and has done since June 2024!).

For many gamers now, video games are all about being immersed in virtual environments that are almost indistinguishable from reality. The cost of meeting this player expectation increases after every release, as players want their new games to be better than the last.

To meet this demand, advancements in technology must be made. Photorealistic graphics, greater scale and depth, and more sophisticated AI are features that many AAA developers consider the bare minimum for what it takes to deliver a game that will meet the hype. Creating these improved features requires greater budget, resource, and talent from both the developer and the game engines themselves.

Retaining the talent needed to craft great games is another challenge in itself. A study conducted by Bain & Company suggests that the most common reason why employees join a gaming company is for their own passion for games. But take that initial passion and spread it over the long-term, and it becomes clear that a work-life balance, compensation and supportive leadership become more important. The high attrition rates for key talent suggests that the gaming industry still has a way to go in investing further into their workforce.

So, creating games that meet player expectations means more money is needed. To get more money, game studios need more investment. The tough reality of game studios getting investment in the current landscape is that they must justify every direction of their spending in much more depth than ever before.

“There is a lot more scrutiny. There has always been scrutiny, but there is just a lot more" says Spike Laurie, partner at VC Hiro Capital.

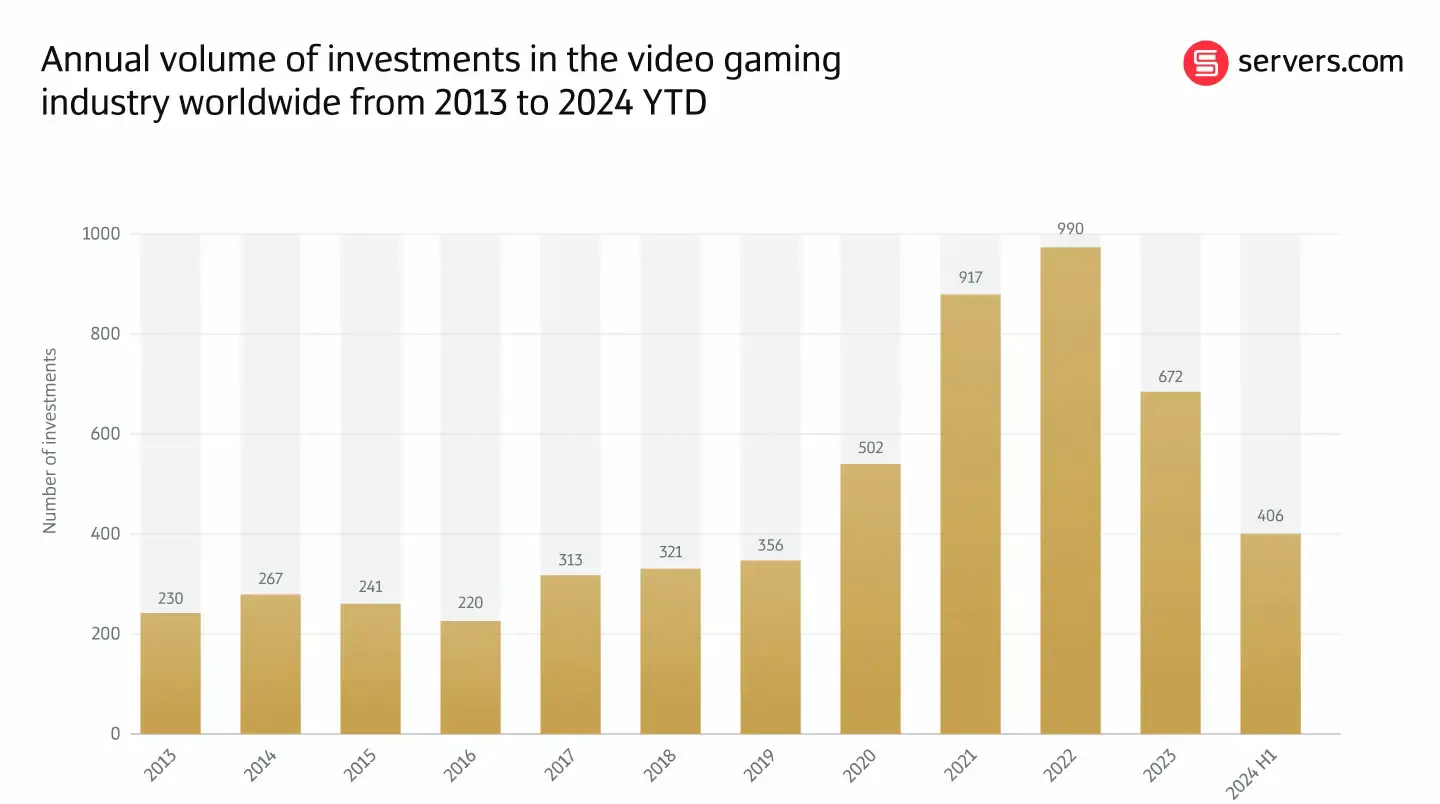

In 2023, investment in game studios fell by 32% from the previous year. In volume terms, according to data from Statista, that was a drop from 990 investments in 2022, to 672 in 2023. In H1 of 2024, there were 406 – a further drop of 40%.

It’s not a pretty picture.

But if we review these numbers in the context of pre-pandemic figures, they don’t look quite so dire. In 2019, 356 investments in the video gaming industry were made. So, they’re still better than they were. The concern is that these numbers continue to follow this steep curve downwards and that the fight for investment remains tough.

Source: Statista

"This might be one of the hardest times that the game industry has known," said Eliana Oikawa, CEO of investment company Wings.

The fallout following the false sense of numbers that the pandemic created, high interest rates that haven’t dipped as quickly as expected, and rising inflation means it’s a harder pitch than ever to secure venture capital.

"The bar is super high right now. Before, a great game idea plus a great team used to cut it. You could walk out and get a couple of million dollars from a West Coast VC pretty easily with that. Now, it's about how are you validating this? What can you show me… have you made a trailer? And do you have a Discord community that really loves the concept? Are you using companies to play test so you can validate and get real feedback?” continues Laurie.

This level of scrutiny does not favour the smaller and more independent studios who lack the resource to match what the investors are asking of them and many are closing up shop. The popular refrain “survive till ‘25” shows just how hard 2024 has proven to be.

All of this said, investors still believe that the industry will eventually become an attractive place to invest again.

Laurie’s advice - "I think in 2025 we will start to see green shoots of new opportunities. Until then, people will need to focus on business essentials, which is: Can you make more money than you can spend?"

One of these business essentials needs to be infrastructure and really scrutinising where and how changes to a studio’s infrastructure set up could be made to decrease the demand it’s putting on the bottom line.

For years now, hyperscale cloud has been the default option for hosting a game studio’s infrastructure. The instant scalability that it offers is incredibly attractive, particularly for periods of unpredictable scaling patterns, with the ability to spin up servers instantly to meet player demand.

A game developer in a previous life Rob Schoeppe, Chief Commercial Officer of AccelByte, knows the challenge of predicting player demand:

“My number one fear would be ‘do I really need that much server capacity’ when launching a game. Then the negative would happen where we would under-provision, and we wouldn’t have enough capacity to meet the demand.”

The problem is that the scalability that hyperscale cloud provides comes at a cost. Liam Brennan, Director of Games Technology and Services at Tencent puts it simply: “Hosting on the cloud can be very expensive.”

With the enticement of free credits and sign-on discounts this cost isn’t always clear at the outset. But eventually the free credits will disappear and when this happens businesses see their infrastructure costs increasingly eat into their budget, far more than they originally anticipated.

The question is – what other options can provide the same level of scalability at a lower cost?

The reality is that hyperscale cloud is unique in its scalability. But most game studios don’t need the level of scalability that hyperscale cloud provides all the time. They need it for peak periods of player numbers or when they are launching a new game and are unable to predict how many players they’re going to get.

One method that game studios can adopt to significantly reduce their infrastructure spend is by switching to bare metal for their concurrent user (CCU) baseline, whilst retaining hyperscale cloud for those peak periods. Combining bare metal with hyperscale cloud to create a hybrid environment mitigates that risk of under provisioning, as you are still able to spin up capacity in a matter of minutes.

“Traditionally what I tell people, especially when you’re ramping up servers, is forecast your CCU and then secure [bare metal] capacity to meet at least 30-50% of that demand. And then if you can cover that risk, you can burst and figure out whether you want to use hyperscale cloud or otherwise. That’s how you manage risk and cost in the best way possible,” explains Rob Schoeppe.

Rob Schoeppe, CCO of Accelbyte, reveals what game studios can do to reduce their infrastructure spend.

The industry’s view of whether the cost management challenge will improve in 2025 is mixed. One thing that people do seem to agree on is that some things need to change permanently to give the industry the best chance of a positive future.

“Unless we start planting differently, unless we start changing the way we work and think about making games, then we're going to continue to see the highest highs and the lowest lows that games have ever seen,” said Xalavier Nelson, studio head of Strange Scaffold.

History has shown that periods of difficulty have eventually led to change for the better and have often driven innovation. I hope to see a better, more considered approach to infrastructure come out of this period and that chronic overspending on gaming infrastructure - through lack of exploring other options - is left behind.

I’d love to hear your thoughts and answer any questions you may have on this topic. To continue the conversation, you can find me on LinkedIn.

Combining a background in business management and a genuine passion for gaming, Jarrod is uniquely positioned to consult and supply gaming companies of every form, from indie startups through to AAAs.