Video on demand (VOD) market volume is projected to reach in excess of $230 billion by 2027. Today, VOD platforms like Netflix, Disney+, and HBO Max are household staples.

But it’s a double-edged sword. Global VOD success has resulted in a highly competitive landscape making it increasingly challenging for VOD platforms to remain profitable.

Even if not by name, almost everyone will be familiar with the SVOD (subscription-based-video-on-demand) model. It’s the revenue model used by the likes of Netflix and allows users to access the platform’s content catalogue for a monthly fee.

But now, influenced by various factors from the rising cost of living to subscription fatigue, the VOD industry is increasingly looking to AVOD (advertising-based-video-on-demand) to keep users engaged.

In this blog, we explore the differences between these two revenue frameworks and why some industry experts are predicting that AVOD will soon overtake SVOD.

As we’ve just mentioned, AVOD stands for advertising-based-video-on-demand. AVOD is a VOD monetization framework that integrates advertisements into the viewing experience.

Ads typically appear before, during, and/or after the content and viewers are required to watch the ads to access the desired content.

Because the ad revenue offsets the production costs, AVOD platforms can offer their content for free – YouTube is a prime example.

SVOD stands for subscription-based-video-on-demand. Much like AVOD, SVOD is a VOD monetization framework. But unlike an AVOD model, SVOD does not generate revenue from ads.

Instead, SVOD platforms like Netflix and AppleTV work more like pay TV packages (like Sky TV, for instance), with users paying a recurring fee (usually monthly) for access to a catalogue of curated on-demand content.

This framework provides the VOD platform with a predictable revenue stream. In return users enjoy unlimited access to premium video content across devices.

Both AVOD and SVOD make it possible for streaming services to deliver on-demand content to users. The key difference is revenue generation.

The table below illustrates the difference in functionality between AVOD and SVOD, as well as some key differences between the two.

|

AVOD |

SVOD |

|

|

Monetization |

Users access unlimited video content for free, but content has integrated ads. |

Viewers pay a regular fee for access to a catalogue of ad-free video content. |

|

Revenue |

Income from ad revenue is unpredictable. |

SVOD platforms get predictable, recurring revenue from subscription payments. |

|

Market share |

AVOD usually generates lower revenues than SVOD. AVOD revenues for TV series and movies are projected to reach $68 billion by 2029. |

SVOD usually generates higher profit margins per thousand subscribers and represents the largest segment of the OTT market. SVOD revenues are projected to reach $127 billion by 2029. |

|

Barriers to entry |

Low financial barrier to entry for users. |

Higher financial barrier to entry for users. |

|

Examples |

Pluto TV, Tubi, Roku Channel, Plex, Crackle |

Netflix, Amazon Prime Video, Hulu, Apple TV, HBO, Disney+ |

Until recently, SVOD has been the VOD framework of choice for most on-demand streaming services. SVOD penetration is particularly strong in the United States where 71% of households with internet access use an SVOD service.

But research suggests that SVOD primacy might be on the decline. In some emerging markets like Latin America, where utilization of free streaming services increased from 14% to 80% between 2019 and 2024, ad-supported services have always been the go-to choice. And now the rest of the world is moving in the same direction. As of 2024, 57% of U.S. households already subscribe to ad supported tiers.

“Having more choice with low financial risk keeps consumers engaged and watching”, comments Alexandra Ong, business development director, EMEA at Magnite.

Whether it be due to households cutting back amidst rising living costs or the relatively low financial risk that AVOD and FAST incur for content providers, it’s clear that AVOD is rising in the popularity ranks. The so-called Netflix subscription ‘bubble’ is bursting.

But aside from the public’s appetite for free content, what is causing this industry-wide increase in AVOD adoption?

Free ad-supported content comes with fewer barriers to entry than subscription-based services. Anybody with an internet-enabled device can access content from AVOD platforms, regardless of financial means.

By contrast, the cost of subscription-based services will deter some customers. In fact, cost is the primary reason why existing SVOD customers choose to cancel their subscriptions with one in three stating that subscriptions have become too expensive for what you get.

VOD platforms are realizing that over-reliance on subscriber revenue is risky. Especially given the current state of the economy, streaming services are in turbulent waters.

Switching to an AVOD model or combining subscription and ad-based revenue enables VOD platforms to protect their source of income.

We’re already starting to see evidence of this. Netflix’s ad supported plan which launched back in November 2022 accumulated approximately one million active users in just two months and Deloitte predicts that most online video service subscriptions will be partially or wholly ad-funded by 2030.

At the end of the day, for traditionally subscription-based platforms, adding an ad-supported option is preferable to losing customers to churn.

It’s all connected. As users seek out more affordable content, AVOD is providing a way to maintain audiences.

By offering ad-supported tiers that either reduce or eliminate subscription costs for users, platforms can dramatically increase the scope of their target audiences and maintain growth.

In emerging markets, AVOD has seen great success over the last couple of years. In Latin America, for instance, numerous AVOD platforms like Pluto TV, Roku, and Plex have seen success.

Pluto TV (a subsidiary of Viacom CBS) offers upwards of 25,000 hours of free content from 200 plus content partners to viewers in Latin America.

“We are thrilled with Pluto TV’s amazing performance in Latin America, where it has grown every month since its launch in early 2020” comments Eduardo Lebrija, EVP Chief Commercial Officer at ViacomCBS Networks Americas.

Similar trends are playing out in East Asia, where the AVOD market reached revenues of over $11 billion in 2024.

AVOD makes it easier to distribute different content formats. Whilst SVOD has been reserved primarily for premium content (think the latest series and movies), AVOD lends itself to a much broader spectrum of content including older content and cult classics.

Whilst this kind of content is unlikely to draw subscriptions to an SVOD platform, it is still likely to draw in significant viewer numbers when distributed on a free ad-supported platform.

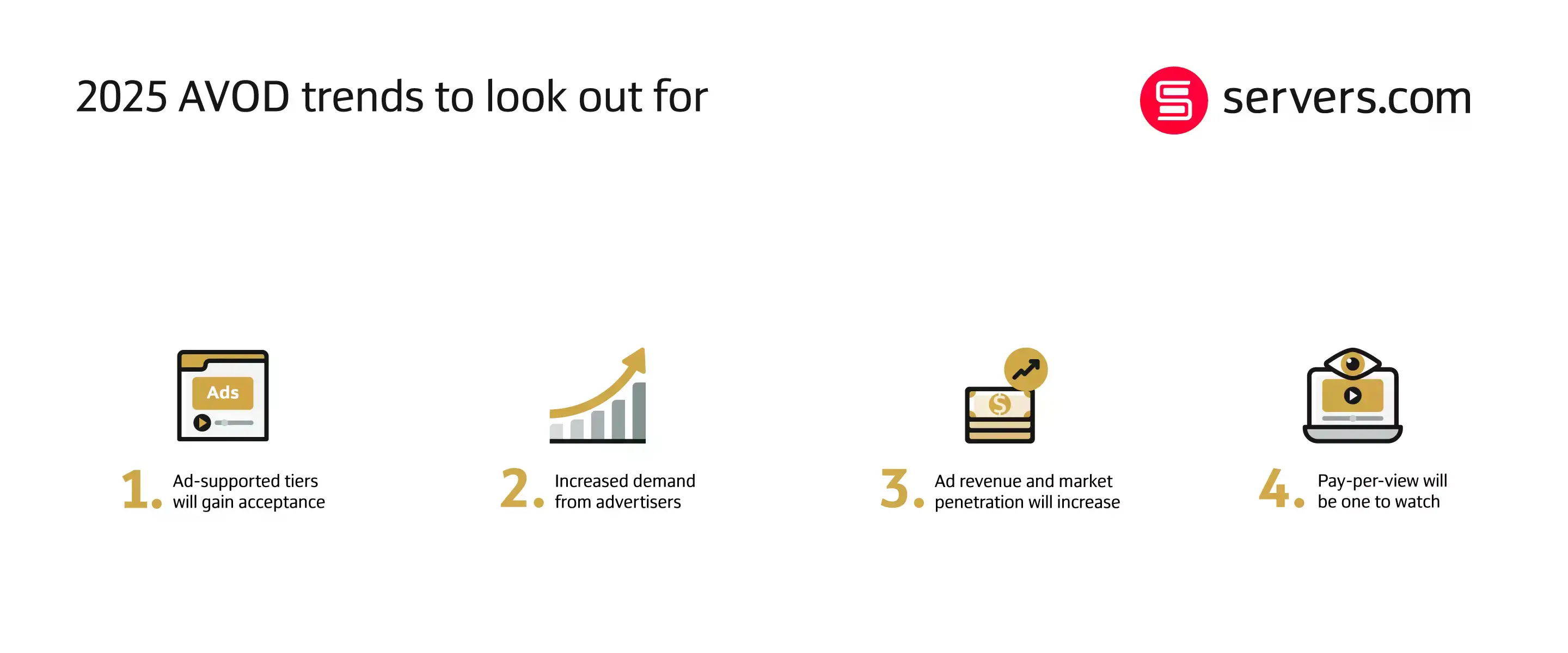

It’s clear that AVOD is taking off globally. And as the AVOD model continues to cement itself, we’re likely to see some emerging trends.

Trends like:

Most streaming services have now integrated ad-supported tiers on their platforms. And this consolidation between SVOD and AVOD is set to continue.

“Many video streaming services, needing to boost profits, continue to raise prices and have rolled out ad-supported plans to give subscribers options,” said Sarah Lee, Research Analyst at Parks Associates.

And contrary to initial concerns, viewers are for the most part welcoming the changes. 92% of Prime Video’s SVOD users are now on ad-supported plans. And research suggests that the reputation of platforms including Prime Video, Netflix and Disney+ actually increased in 2024 compared to previous years.

As AVOD continues to gain popularity, more advertisers will want to buy ad-space. AVOD’s ability to serve highly personalized ads is a big draw for advertisers and it’s changing consumers’ perceptions of ads too.

Unlike the one-size-fits-all advertising served on linear TV, today’s advertising technologies can serve consumers personalized ads that add value to the viewer.

Ad-free entertainment has been one of SVOD’s biggest pull factors. But with this shift to contextual advertising, the draw of ad-free content may become less important to consumers.

Ad revenue is set to increase for streaming services that implement ad-supported tiers onto their platforms.

Take Netflix, for instance. The platforms’ ad-supported tier is only two years old yet it’s already growing exponentially with projected revenues of $3.2 billion in 2025 and $5.25 billion by 2030.

It’s not just Netflix. In the second quarter of 2024, Prime Video reported ad revenues of $12.7 billion, marking a 20% increase from the previous year.

Unlike VOD frameworks, pay-per-view (TVoD) allows viewers to buy access to content for a set time (typically 24 hours).

And now, research shows that more people are choosing to obtain content on a pay per view basis – especially for the purpose of watching special events or exclusive content.

TVoD market revenues have been on a steady incline over the last decade and the number of users is expected to reach 18.5 million by 2027. It’s still some way off catching up with VOD, but it's certainly a streaming trend to watch.

After years of SVOD dominance, all signs point to an AVOD takeover as viewers and streaming platforms alike embrace the benefits of ad-supported content.

Despite initial skepticism, the benefits are already being felt. And as formerly SVOD-only platforms like Netflix and Prime Video have integrated ad-supported tiers, it’s brought viewers better value for money and streaming platforms untapped revenue potential.

Expected to grow by up to three times over the next five years, it’s clear that AVOD isn’t going away anytime soon.