The iGaming industry has continued its strong growth trajectory over the past 12 months. At the close of 2024, the online gambling market was valued at $93.26 billion and it’s expected to reach in excess of $150 billion by the end of 2029.

The boom in mobile gaming, improved payment gateways, technological innovation and regulatory developments across the globe have all contributed to industry success. And this year looks like it’ll bring even more opportunity (and no doubt some surprises).

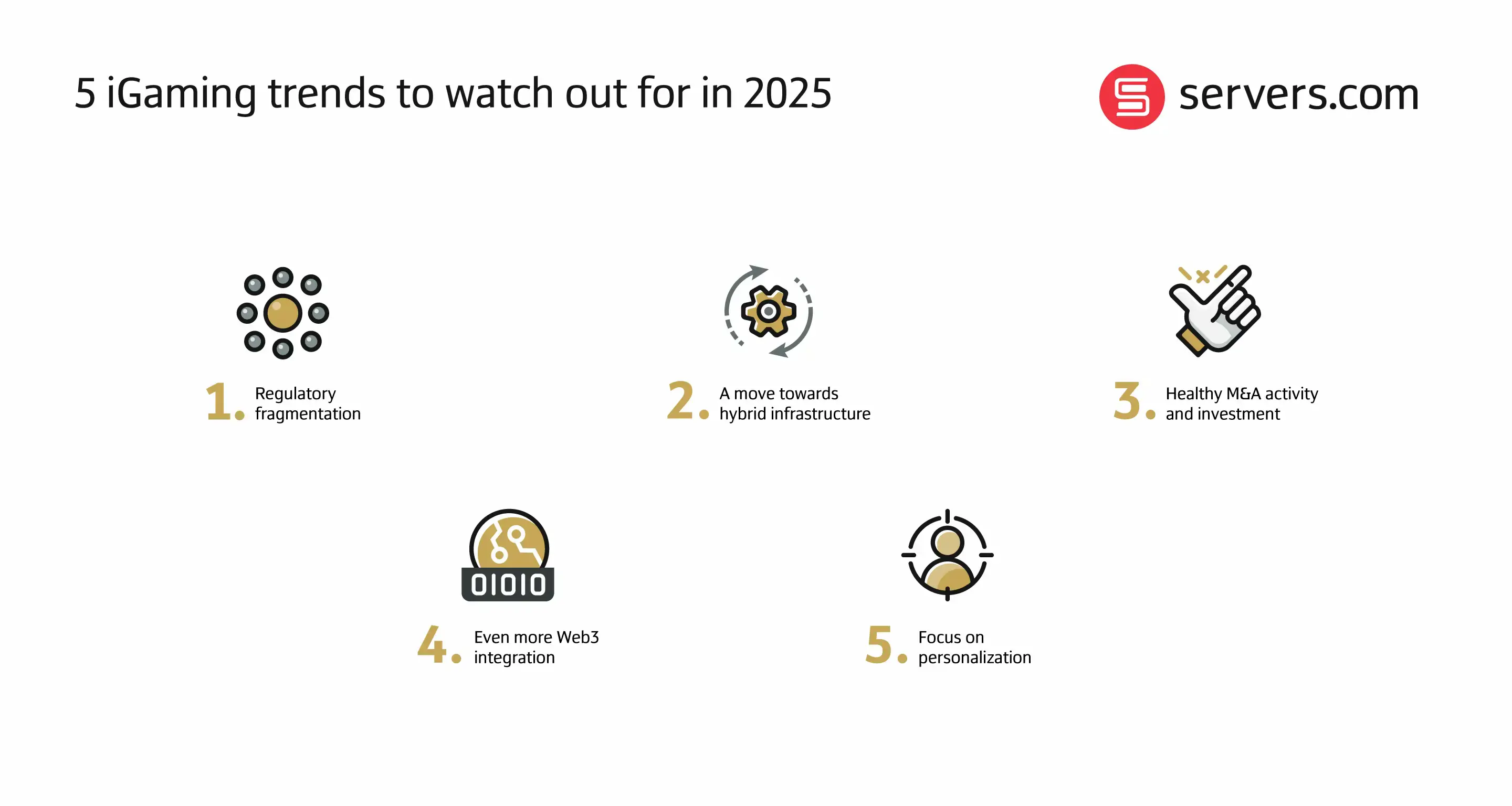

Here’s what I think will be the biggest iGaming trends for 2025.

The U.S. gambling landscape remains fragmented, but it’s expected that even some of the more hardline states will start to consider iGaming legalization this year. As it stands, online sports betting is permitted across 11 states, and online casino games across seven. It’s expected that California, Georgia, Minnesota, South Carolina and Texas could be next in line for legalization.

New Zealand is getting closer to regulating iGaming with plans to license up to 15 operators by early 2026 with 888, Betway and Bet365 among interested operators. By April 2025 we should see a bill introduced in preparation for enacting the new framework.

The European Union is in the process of refining online gambling regulations, with plans to introduce a European Digital Identity framework (EUDI) that will require iGaming companies to verify customer identities using a standardized digital ID system. This follows similar measures already introduced by Australia’s financial crime regulator (AUSTRAC) this past September. France, however, has withdrawn proposed amendments to its 2025 Budget which would have legislated an online casino market.

No doubt, regulation will continue to shift aggressively over the next 12 months bringing both opportunities and challenges for the industry. As the regulatory landscape further fragments, iGaming platforms will need to be quick to comply with local legal frameworks. But with formerly unregulated markets such as Latin America and Africa beginning to draw up formal regulatory structures, this is also an opportunity for operators to get a foothold into promising new markets.

Hyperscale cloud infrastructure has been a staple of the iGaming industry over the past two decades. Offering vast scalability and convenient contracts, hyperscalers facilitated rapid market entry for new online gambling platforms.

And while hyperscale cloud remains an essential resource for the industry, iGaming platforms are starting to diversify their sources of compute – with some companies leaving hyperscale cloud completely.

In part this is due to concerns around unexpected costs, service complexities, and iGaming legal compliance. Platforms are seeking ways to claim back control over their technology stacks. I recently sat down with the CTO of a prominent iGaming platform who had been experiencing issues just like this. He shared that:

“For an organization that values IT as an asset to deliver software that creates revenue, that’s easier to achieve [on-prem] than achieving the same results without having control of the different aspects of technology”.

Platforms that tightly coupled their iGaming infrastructure with proprietary services have found themselves locked into expensive contracts. And to overcome this, more are looking to diversify their technology through a full or partial hyperscale cloud repatriation. Adopting a hybrid infrastructure approach allows platforms to gradually move those workloads that aren’t already entangled to alternative solutions like bare metal cloud, colocation, or even on-premises infrastructure.

Data center location is also set to become even more of a focus this year. Due to the shifting regulatory landscape, some operators are being denied from hosting their iGaming servers in certain locations and forced to host their platforms elsewhere. It’s an ongoing issue and one that will require close collaboration between operators and their iGaming hosting partners to achieve compliant solutions.

Mergers and acquisitions have been on the up across the iGaming industry over the past 12 months with several significant deals taking place towards the end of last year including Entain’s acquisition of Sportnation in September and Bet365’s purchasing of Betflag in October.

Acquisitions and strategic partnerships such as these are key for iGaming operators that want to access new markets and technologies and I’m expecting that we’ll observe similar activity throughout 2025.

Thanks to consistent growth and rapid innovation, the online gambling sector is also becoming one of the most lucrative for strategic investors. Take Betski, for instance, which secured $345K in pre-seed funding this past November after securing interest from multiple investors.

Over the months to come, we can expect that mobile gaming, live casino, eSports, and AI-powered games will remain amongst the top investment segments. But if last year is anything to go by, the biggest portion of capital investment will be funneled into blockchain gaming (which accounted for 40% of total deals in 2024).

It’s predicted that the global online gambling market will reach a valuation of $127.3 billion by 2027. And a significant portion of this growth is being attributed to the rapid rise of crypto casinos and metaverse casinos, which use blockchain technology and incorporate popular cryptocurrencies like Bitcoin and Ethereum.

The decentralized nature of blockchain technology brings greater transparency, anonymity and fairness to online gambling. Along with faster and cheaper transactions, it has helped to increase trust amongst users and attract a new player base of crypto enthusiasts to iGaming.

As of now the biggest hurdle remains regulation. Even though crypto gambling is legal across many jurisdictions including the UK, Canada and some U.S. states, there are restrictions in place and platforms may need to be licensed by their local gambling commission. Undeterred, new players continue to enter the market. Players like BetHog, a new crypto casino and sportsbook founded by FanDuel co-founders Nigel Eccles and Rob Jones.

“The crypto casino market has seen dramatic growth over the past few years, driven by innovations like provably fair games, robust VIP programs, and streaming,” said Eccles.

BetHog announced its public launch along with $6 million in seed funding in November and I’ve no doubt we’ll start to see more new players emerging over this coming year.

Personalized user experiences are part and parcel of most online experiences these days. But until recently, this trend hasn’t extended to the world of online gambling to such a great extent.

“The iGaming sector lags behind other e-commerce sectors,” said Oren Cohen Shwartz, CEO of Dealsport. “For instance, Netflix has seen a shift in its user base from those looking for specific films to those just watching the suggestions. There’s no reason why operators can’t offer the same but on a more innovative level, so it’s time for a change…players should always come first, and operators that have products that offer personalized experiences are more likely to succeed in the long term”.

As we move into 2025, I expect that we’ll see more iGaming operators prioritizing personalization on their platforms with features like tailored content and recommendations. It’ll be essential for the industry to remain competitive. It’ll also be an important strategy for attracting the next generation of players who have much higher expectations.

“Gen Z has grown up with technology that offers tailored experiences and they expect the same level of customization in all their interactions,” said Igor Kaufman, Head of Sport Business at GR8 Tech.

More regions are legalizing iGaming for the first time and new technologies are making way for further innovation. But there will be challenges this year too. Regulatory changes (whilst largely good news for the industry) are unpredictable, and operators are now navigating a newfound precarity when it comes to their infrastructure. Agility and staying abreast of these shifting requirements will need to be a priority for iGaming platforms this year. Nevertheless, there’s no doubt that for those that can adapt, there is even more untapped growth on the horizon.

Those are my iGaming predictions. What do you think will be the top iGaming trends in 2025? Get in touch to share your thoughts.

Jamie Daniel is our iGaming expert and understands the unique challenges faced by the industry. When not cultivating a magnificent beard, he’s working from our UK office.